14+ 2-1 buydown loan

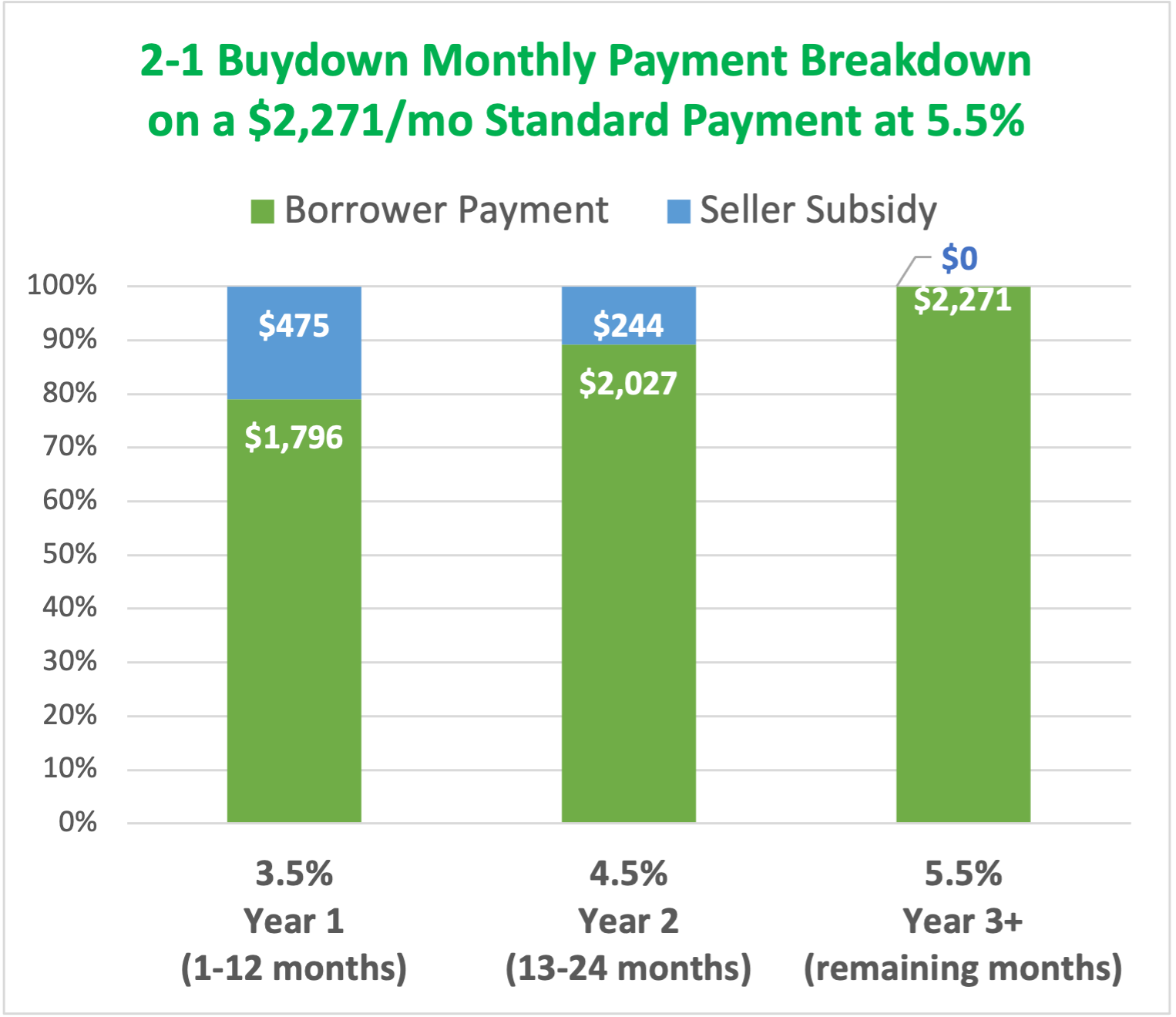

A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months. See B5-34-01 Property Assessed Clean Energy Loans for additional information.

Pdf Microfinance As A Potential Catalyst For Improved Sanitation Christie Chatterley Academia Edu

After the first two years the interest rate rises to 6625 for.

. A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months. Flood Certificate only if applicable See Loan Officer for Details 1400 1600 Tax Service Fee only if applicable See Loan Officer for Details 7800 11000 Processing Fee 77500 Underwriting Fee 67500. Eye catcher loan program of the week.

Once you click I Acknowledge below you will be directed to RMCs Simpleloan online application. Once you click I Acknowledge below you will be directed to RMCs Simpleloan online application. MCC showing the rate of credit allowed and annual cap Lender calculation of the adjustment to income Copy of the borrowers IRS Form W4 to reflect the tax credit is taken on a pay.

Maronda Homes introduces Lehigh Acres a new construction scattered lot community in Lehigh Acres. The 30-year FHA conforming loan is limited to loans of 562350 in the Inland Empire and 647200 in LA and Orange counties. Introducing Blackwater Creek Athletic Area Less Than 2 Miles From Your Front Door.

Maronda Homes introduces Palm Bay a new construction community in Palm Bay FL. Schedule an appointment to view our model home today. Enjoy all that Downtown Lynchburg has to offer.

Even higher loan amounts are available for 2-4 units and in Hawaii and Alaska. A loan for the purchase of a home that has yet to be constructed or a loan to purchase a home under construction ie construction is currently underway is a construction loan to build a home for the purposes of 102619e3ivF. A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months.

Flood Certificate only if applicable See Loan Officer for Details 1400 1600 Tax Service Fee only if applicable See Loan Officer for Details 7800 11000 Processing Fee 77500 Underwriting Fee 67500. After the first two years the interest rate rises to 6625 for. In variable-rate transactions that have a term greater than one year and are secured by the consumers principal dwelling the creditor must give special early disclosures under 102619b in addition to the.

See for example the discussion of buydown transactions elsewhere in the commentary to 102617c The fact that a term or contract may later be deemed unenforceable by a court on the basis of equity or other grounds does not by itself mean that disclosures based on that term or contract did not reflect the. After the first two years the interest rate rises to 6625 for. Jeff Lazerson is a mortgage.

A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months. PRMG announces 2-1 and 1-0 Buydown options on FHA VA and USDA Loans. After the first two years the interest rate rises to 6625 for.

3 beds 2 baths 1463 sq. A 30-year 2-1 temporary buydown conforming purchase fixed mortgage locked at 399 for the first year with two points cost and 222 subsidy points. After the first two years the interest rate rises to 6625 for.

However if a use and occupancy permit has been issued for the home prior to the issuance of the. As an example using the average mortgage 415000 with a 30-year term a 2-1 buy-down would cost approximately 9000 and a 3-2-1 buy-down would cost around 17000. 3570 Seafoam Ln Jacksonville FL 32250 579000 MLS 1191803 Lovely Pool Home in Isle of Palms area.

A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months. Eye catcher loan program of the week. A year ago at this time.

Schedule an appointment to view our model home today. Guaranteed Loan Program Technical Handbook. Enjoy miles of trails playgrounds a dog park more minutes from Locust Thicket.

Direct mortgage lender since 1978. Maronda Homes introduces Windmont Farms a new construction community in Gibsonia PA. Newer Roof and Windows Stain.

Schedule an appointment to view our model home. For certain transactions on properties that have a Property Assessed Clean Energy PACE loan borrowers who refinance the first mortgage loan and have sufficient equity to pay off the PACE loan but choose not to do so will be ineligible for a cash-out refinance. 14 1 Comment.

Schedule an appointment to view our model home today. A 30-year 2-1 temporary buydown conforming purchase fixed mortgage locked at 399 for the first year with two points cost and 222 subsidy points. A 2-1 buydown would have your principal and interest payment at 4625 for the first 12 months and 5625 for the second 12 months.

Loan file must contain copies of the following. After the first two years the interest rate rises to 6625 for. Maronda Homes introduces Bradford Ridge a new construction community in Leesburg.

Nation wide home loans and refinance from Intercap Lending with great rates and five-star service. 2 days agoThe latest weekly survey data from Freddie Mac shows the 30-year fixed-rate mortgage rose 14 basis points from last week to 708 accelerating its upward trajectory.

What Is A 3 2 1 Buydown Mortgage

3 2 1 Mortgage Buydown Calculator Cmg Financial

Gary Lawrence Realtor Home Facebook

What Is A 2 1 Buydown

What Is A 2 1 Buydown Loan Mortgage Equity Partners

How Can Temporary Interest Rate Buydowns Help Borrowers

:max_bytes(150000):strip_icc()/GettyImages-957745706-a3e0d38cb82b49cd893802fbd35ab13c.jpg)

2 1 Buydown Definition

Have You Heard Of A 2 1 Buydown As An Interest Rate Strategy Not Every Lender Can Offer This Kind Of Program But We Can If You Need Further Explanation Then Please Reach

:max_bytes(150000):strip_icc()/house_for_sale114958475_copy-5bfc3280c9e77c00519bf0c0.jpg)

3 2 1 Buydown Mortgage Definition

Real Estate Finance Ninth Edition Ppt Download

Andrea Stoute Gmfs Mortgage Loan Officer Lafayette La

3 2 1 Buy Down Mortgage Awesomefintech Blog

Caden Turner Gmfs Mortgage Baton Rouge Louisiana

2 1 Buydown Loan

2 1 Buydown Loan

What Is A 2 1 Buydown Loan Mortgage Equity Partners

Goklcjfnmtqf M